As summer 2024 approaches, the debate intensifies between Bitcoin (BTC) and Ethereum (ETH), two major players in the cryptocurrency market. Bitcoin is increasingly viewed as a digital gold, offering stability in times of economic uncertainty.

This perception is supported by its reduced volatility post-halving, now lower than that of many S&P 500 companies, according to Fidelity.

Ethereum continues to push the envelope with technological innovations like the recent Dencun upgrade, which aims to cut fees and enhance scalability. However, these changes have brought back inflationary aspects, moving away from the deflationary trend set by the 2022 Merge.

This has led to heightened volatility, with Ethereum’s implied volatility remaining significantly higher than Bitcoin’s despite the overall market calming.

With their divergent roles in investment portfolios—Bitcoin as a burgeoning digital asset and Ethereum as a technological pioneer—Finbold sought insights from ChatGPT, OpenAI’s advanced AI model, to determine which might excel in the coming months.

This analysis highlights the need to evaluate Bitcoin’s appeal as a growing store of value against Ethereum’s progressive platform in a rapidly changing market landscape.

ChatGPT’s analysis: Bitcoin vs. Ethereum investment prospects

According to ChatGPT, the decision largely depends on individual investment strategies and risk tolerance. Bitcoin is generally better suited for investors seeking stability and a relatively safe store of value, akin to digital gold, especially amidst economic uncertainties. It appeals to risk-averse individuals or those new to cryptocurrencies.

ChatGPT Bitcoin investment prospects. Source: Finbold and ChatGPT

Conversely, Ethereum fuels a platform for decentralized applications and is a major player in blockchain technology. Investors who believe in the future of these technologies may prefer Ethereum.

ChatGPT Ethereum investment prospects. Source: Finbold and ChatGPT

ChatGPT Ethereum investment prospects. Source: Finbold and ChatGPT

While Bitcoin offers stability and potential for incremental growth, Ethereum provides a gateway to a rapidly evolving blockchain ecosystem with higher risk and potentially higher rewards.

Ultimately, diversification with both BTC and ETH can be a way to manage risk and potentially benefit from the growth of both major cryptocurrencies.

Bitcoin and ETH recent price performance

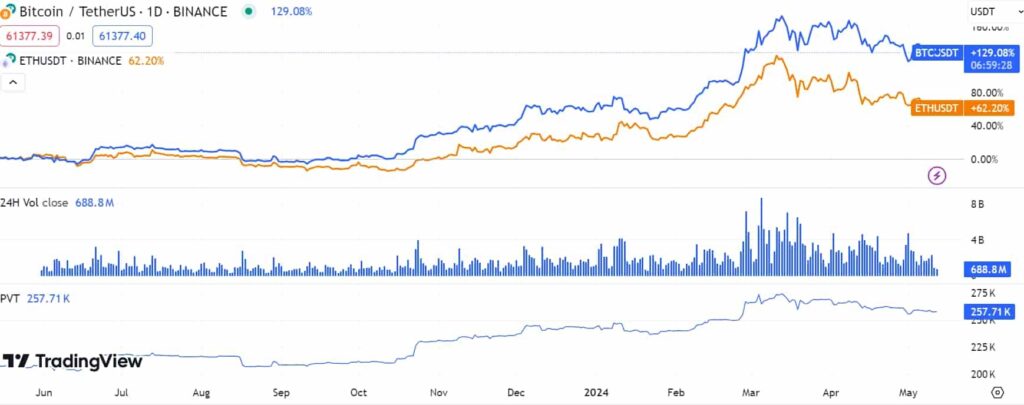

Bitcoin and Ethereum price chart. Source: TradingView

Bitcoin and Ethereum price chart. Source: TradingView

As of 2024, the year-to-date performance of Bitcoin and ETH presents a clear contrast in investment returns. Bitcoin has seen a significant rise, with a YTD increase of 45.16%, showcasing its volatile yet high-growth nature. The current price of Bitcoin stands at approximately $61,200.

On the other hand, ETH has gained 28% YTD, with its current price at about $2,921.

The choice between Bitcoin and Ethereum should align with individual investment goals, risk tolerance, and interest in the technological aspects of cryptocurrencies.

While Bitcoin offers stability and potential for incremental growth, Ethereum provides a gateway to a rapidly evolving blockchain ecosystem with higher risk and potentially higher rewards.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.