When it comes to preventing credit card fraud, the companies that issue your credit card and the payment networks they run on — Visa, Mastercard, Discover and American Express — do a lot to keep your identity and transactions safe. But is it enough?

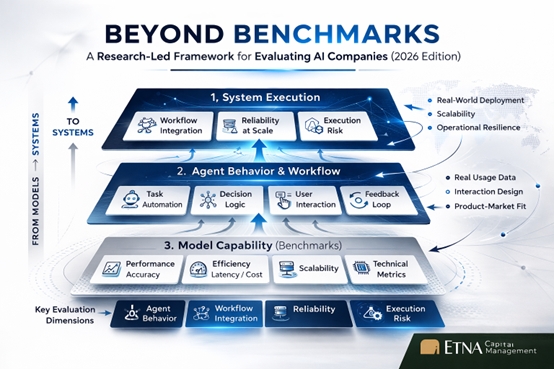

One way these networks have kept your transactions secure for the better part of the last decade has been by leveraging artificial intelligence, or AI, and machine learning programs.

However, as fraud protection advances, so too do the tools and scams fraudsters use to obtain your information. Total fraud losses in the US reached $10 billion in 2023, according to the Federal Trade Commission, a 14% increase over fraud losses in 2022.

Credit and debit cards had a combined loss of $466 million in 2023, according to the FTC’s Consumer Sentinel Network book. The report lists identity theft as the most prevalent form of credit card fraud.

Despite these daunting numbers, there are ways you can help protect your card information from bad actors. Credit card issuers have an arsenal of tools to help protect your information, and there are precautions you, as an individual, can take to keep your information secure.

How can AI help prevent fraud?

AI makes it possible to sift through trillions of data points in the blink of an eye. It can help card networks, and by extension, the banks that issue credit cards, determine in nearly real time whether a transaction is legitimate.

“What we try to do is identify [your] transactions when they hit the network. So, we’re building these AI models to try to identify patterns around transactions. We can actually stop [fraud] as it’s happening,” said James Mirfin, senior vice president, global head of risk and identity solutions at Visa.

Common types of fraud

There are four common types of credit card fraud, according to Equifax, one of three major credit bureaus.

- Card cloning: This typically happens after your card information has been stolen. A bad actor will then print it onto a blank card in order to use it for unauthorized charges.

- Skimming: This form of fraud involves a tool called a skimmer. It’s hidden within a legitimate card scanner like those found on ATMS and gas pumps. It makes a copy of the information contained within your card’s magnetic strip and saves it for the fraudster to use.

- Card-not-present: This occurs when your card info is stolen during a card-not-present transaction. CNP transactions include online, phone or mail orders — anytime you make a purchase and the merchant doesn’t see your physical card. This can also happen during data breaches, phishing scams or malware attacks.

- Card present: When someone uses a cloned card or otherwise fraudulently duplicated card information to make an unauthorized purchase in person.

Imposter scams, online shopping scams, and prize, sweepstakes and lottery scams are the most prevalent, according to the FTC’s report. Social media platforms are a common place for online shopping scams to occur, the report also found.

Additionally, romance scams remain popular, with fraudsters using AI to trick their victims. According to Visa’s Biannual Threat Report, fraudsters are using generative AI to create advanced phishing campaigns, deep fake dating profiles and voice cloning to spoof loved ones.

“Two years ago, if you received a phishing email, it was [filled with] grammatical errors. Now, [bad actors] are using generative AI to create really, really well-written emails for phishing,” Mirfin said.

He noted that a few years ago it used to be relatively easy to pick out an AI-generated voice. “Now, they can do real-time voice cloning… with a small sample of someone’s voice.”

How networks prevent fraud

Each card network leverages AI to help ensure your transactions are legitimate. But they all use different tools to do so.

Visa

Visa recently announced new payment technology that leverages AI to keep your card information more secure. The card network utilizes biometric confirmation for online transactions as well as allowing people to store all of their payment methods within one credential, potentially eliminating the need to carry physical cards.

Additionally, Visa’s Advanced Authorization uses machine-learning models to detect fraudulent transactions. The company has three AI-powered solutions to help reduce fraud during account-to-account (like via Venmo or Zelle) and card-not-present transactions.

“They’re all designed to protect transactions on the network,” Mirfin said, noting that the products work in the background so you likely won’t even be aware of them. “You should just have confidence that that transaction is going to be successful and that no one else is going to be able to use your credentials.”

Mastercard

Mastercard uses the speed of generative AI to prevent fraudulent transactions. Its Decision Intelligence helps banks score and approve billions of transactions annually.

“Supercharging our algorithm will improve our ability to anticipate the next potential fraudulent event,” Ajay Bhalla, president of Cyber and Intelligence at Mastercard, said in the press release announcing Decision Intelligence.

American Express

American Express uses machine learning-powered fraud detection to monitor and detect fraud whenever an Amex card is used. According to the network and card issuer, the fraud detection technology covers $1.2 trillion in transaction value annually. Amex was also an early developer of AI fraud detection tools.

Discover

Discover uses machine learning-based fraud detection tools to help prevent fraud as well as to help its merchant partners avoid supply chain shortages.

“We are leveraging AI to help monitor, detect and alert our partners to potential fraud, and many of our partners are embracing AI for predictive forecasting and automation to more accurately anticipate demand and adjust inventory and staffing,” Andrew Stucchio, vice president of global pricing and analytics at Discover® Global Network, said in a press release.

Discover also has a program called ProtectBuy that validates customer identity at the time of purchase. It requires the merchant, network and issuer to verify the sale isn’t fraudulent. If a transaction is flagged as fraudulent, a one-time password is sent to the cardholder to use to confirm the transaction.

What you can do to protect yourself from credit card fraud

While your card network is doing what it can to help keep your information secure, there are steps you can take as well to help keep your card information secure.

- Sign up for a free credit monitoring service. There are a handful of free applications that will monitor the dark web for your personal information, including your email, address, passwords or Social Security number.

- Update your antivirus protection. If you often shop from a computer, make sure your virus protection software is up to date. This can help prevent any malware from stealing your information.

- Use a virtual card number when shopping online. Virtual card numbers are unique numbers that replace the physical number on your actual card. It prevents merchants from saving your card data.

The bottom line

Artificial intelligence is being used to both protect and attack. Networks like Visa and Mastercard use this developing technology to detect whether transactions made on the networks are fraudulent. At the same time, the tactics used by criminals have been bolstered by AI, particularly thanks to voice cloning and generative AI platforms.

“Visa spent $10 billion over the last five years in technology and innovation to try to stay in front of this stuff,” Mirfin said. “But it’s just an arms race.”

The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners.