International Business Machines Corporation (NYSE:IBM) recently completed the twin acquisitions of StreamSets and webMethods to augment its AI platform and automation capabilities. The buyouts will offer comprehensive application and data integration platforms in the industry and help business enterprises undergo rapid digital transformation by embracing generative AI.

Complementing IBM DataStage and Databand platform with a hybrid and multi-cloud approach, the buyouts will offer an integrated product for clients to facilitate seamless applications and services. This, in turn, will enable clients to effectively manage data quality within a distributed data landscape with real-time data streaming for a faster response and informed decision-making process.

What Do the Acquisitions Bring to the Table?

StreamSets is a real-time data integration firm specializing in streaming structured, unstructured and semi-structured data across hybrid multi-cloud environments. It extends the breadth and depth of IBM Data Fabric’s data integration capabilities through continuous, real-time processing, integration and transfer of data when it is available, reducing latency and data staleness. This helps users ingest, enrich and harness the potential of streaming data through features such as offset handling and delivery guarantees.

webMethods is an Integration & API Management platform that runs in the cloud, on-premise, in hybrid or multi-cloud environments. Leveraging the webMethods Integration Platform as a Service (iPaaS), it helps organizations manage the tangled web of systems, applications and data silos within business environments by enabling users to deploy and execute integrations anywhere. It will enable IBM to meet local data sovereignty requirements while driving enterprise-wide innovation by offering customers a path to multi-cloud hybrid integration.

Scaling AI Solutions

In March this year, IBM took a giant step forward in enterprise AI innovation by integrating the open-source Mixtral-8x7B large language model into its watsonx AI and data platform. Built on innovative Sparse modeling and the Mixture-of-Experts technique, this model excels in rapid data processing and contextual analysis. Its ability to efficiently handle vast datasets makes it a valuable asset for businesses seeking actionable insights.

IBM’s Watsonx platform is likely to be the core technology platform for its AI capabilities. Watsonx delivers the value of foundational models to the enterprise, enabling them to be more productive. This enterprise-ready AI and data platform comprises three products to help organizations accelerate and scale AI — the watsonx.ai studio for new foundation models, generative AI and machine learning; the watsonx.data fit-for-purpose data store, built on an open lake house architecture; and the watsonx.governance toolkit to help enable AI workflows to be built with responsibility and transparency.

Industry Collaborations to Tap Generative AI

IBM works closely with a diverse AI partner ecosystem through an open and collaborative approach to plan, build, implement and operate generative AI solutions. This open ecosystem approach is likely to help clients define the right models and architecture to deliver their desired outcomes.

IBM collaborated with SAP SE (NYSE:SAP) to tap generative AI technology within the retail industry. The collaboration is likely to facilitate higher productivity and help accelerate business transformation in consumer-packaged goods and retail firms. The company also collaborated with Salesforce, Inc. (NYSE:CRM) to drive increased productivity and help accelerate business transformation with generative AI.

Down But Not Out

Despite solid hybrid cloud and AI traction, IBM is facing stiff competition from Amazon Web Services and Microsoft Corporation‘s (NASDAQ:MSFT) Azure. The company’s ongoing, heavily time-consuming business model transition to the cloud is a challenging task. Weakness in its traditional business and foreign exchange volatility remain significant concerns.

IBM Outperforms Subindustry

Over the past year, IBM has gained 33% compared with the industry’s growth of 24.1%. However, it lagged Microsoft, which rose 35.1% over the same period.

Image Source: Zacks Investment Research

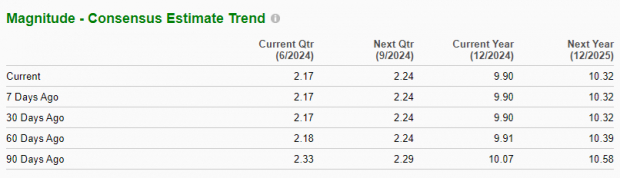

IBM Estimate Movement

Image Source: Zacks Investment Research

Earnings estimates for IBM for 2024 have moved down from $10.07 to $9.90 over the past 90 days, while the same for 2025 has declined from $10.58 to $10.32.

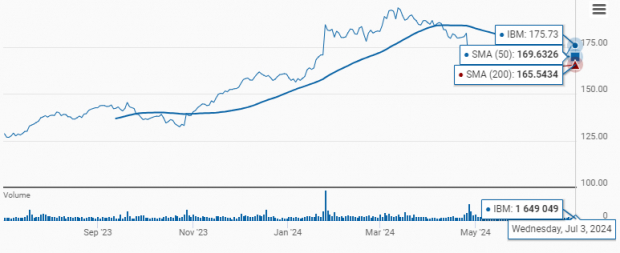

IBM Trading Above 50-Day Moving Average

Image Source: Zacks Investment Research

Intel (NASDAQ:INTC) is currently trading above the 50-day moving average.

Wrapping Up

IBM aims to benefit from the increasing propensity of business enterprises to undertake a cloud-agnostic and interoperable approach to secure multi-cloud management with a diligent focus on hybrid cloud and AI solutions. A better business mix, improving operating leverage through productivity gains and increased investments in growth opportunities will likely drive its profitability.

However, with a Zacks Rank #4 (Sell), it appears that the recent initiatives have mostly fallen flat as it plays a catch-up game with its rivals. With declining earnings estimates, the stock is witnessing a negative investor perception. Consequently, it might not be a prudent investment decision to bet on the stock at the moment.

To read this article on Zacks.com click here.