Adobe Inc. (NASDAQ:ADBE) is a dominant player in the software industry, boasting a global market share of over 80%. The company is poised for significant growth, particularly through its ongoing investments in artificial intelligence tools designed to enhance user productivity and effectiveness in the digital space.

The company’s portfolio includes powerful software offerings, with its most substantial competitive advantage lying in creative applications. Its customer relationship management solutions are also likely to continue growing and adding value. Adobe’s integration of AI into its products, especially its flagship Photoshop platform, positions it to outcompete generative AI competitors with its advanced capabilities and nuanced editing features. This stronghold in professional creative applications is expected to persist and potentially expand as technology and digitization trends grow.

The stock has experienced a volatile first half of 2024, with the market initially overreacting to seemingly softer second-quarter earnings guidance. Despite this, Adobe’s core customers have remained loyal, as evidenced by the growing multiyear backlog and annualized recurring revenues. Since the initial dip, Adobe’s stock has rallied by 19.1%, significantly outperforming the broader market’s 9.7% gain.

Adobe: Leading the Charge in AI-Powered Creative Software

ADBE Data by GuruFocus

The quarterly results demonstrated double-beat performances and led to an upward revision of the fiscal 2024 guidance, highlighting the company’s robust SaaS offerings. Adobe presents a compelling investment opportunity for those seeking capital appreciation, supported by strong AI-driven top- and bottom-line growth. The company’s monetization of AI technologies is just beginning and it is well-positioned to capitalize on the overall growth of the generative AI software industry. Its extensive product suite provides a solid foundation to leverage new AI advancements.

Let’s delve deeper into Adobe’s AI developments to examine their impact on its growth prospects.

Adobe is extensively incorporating AI into its Creative Cloud, Document Cloud and Experience Cloud platforms. AI tools like Adobe Firefly are enhancing applications such as Photoshop, Illustrator and Premiere Pro. Given the company’s core market of professional creativesincluding designers, photographers, videographers and marketersthe integration of AI strengthens its position. It is unlikely competitors like OpenAI’s Sora or other generative AI models will match Adobe’s capabilities in the advanced creative domain anytime soon. Therefore, Adobe is poised to maintain its dominance as the preferred application suite for creative professionals.

Story continues

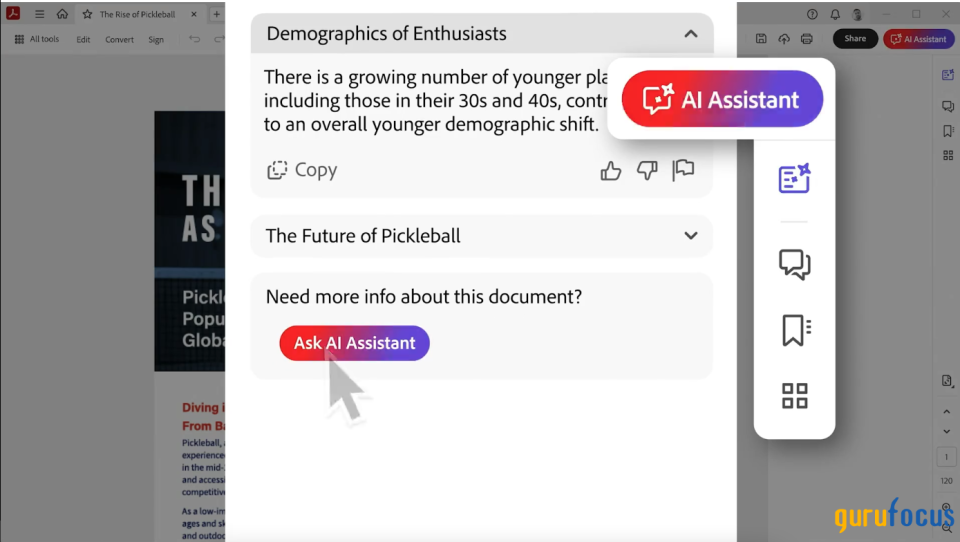

Successful AI monetization strategies

Adobe’s strategic AI investments are already yielding significant returns. Unlike other enterprise companies experiencing a slowdown in spending, the company has remained resilient. The introduction of the Acrobat AI Assistant, available through an add-on subscription for both enterprise and individual users, has seen tremendous demand. This feature, accessible across desktop, web and mobile, contributed to a 19% year-over-year increase in Document Cloud revenue. The net new Document Cloud annual recurring revenue hit a record $165 million in the second quarter, marking a 24% year-over-year gain.

Adobe: Leading the Charge in AI-Powered Creative Software

Source: Adobe

Additionally, Adobe is integrating Firefly into Acrobat, allowing users to create and edit images in PDFs via text prompts. The commercial release of Firefly, along with features like generative fill in Photoshop and AI-enhanced video editing tools in Premiere Pro, signals a promising operational future for the company. These features are likely to drive free-to-paid conversions of Acrobat, bolstered by a significant growth in Acrobat Web’s free monthly active users. The company’s strategic monetization of AI tools is evident through these developments, higher user retention and enterprise deals, showcasing its potential as a major AI beneficiary.

Expanding market reach with AI-driven products

The popularity of Firefly is steadily increasing, contributing to higher renewal rates and migration to higher-ARPU Creative Cloud plans. Adobe’s deliberate approach to monetizing its AI tools has laid a solid foundation for future growth. The integration of AI across its product suite is not only enhancing functionality, but also expanding its market reach. The company’s ability to convert free users to paid subscriptions, coupled with strong enterprise adoption of its AI-driven products, underscores its potential for sustained growth and leadership in the digital and creative software markets.

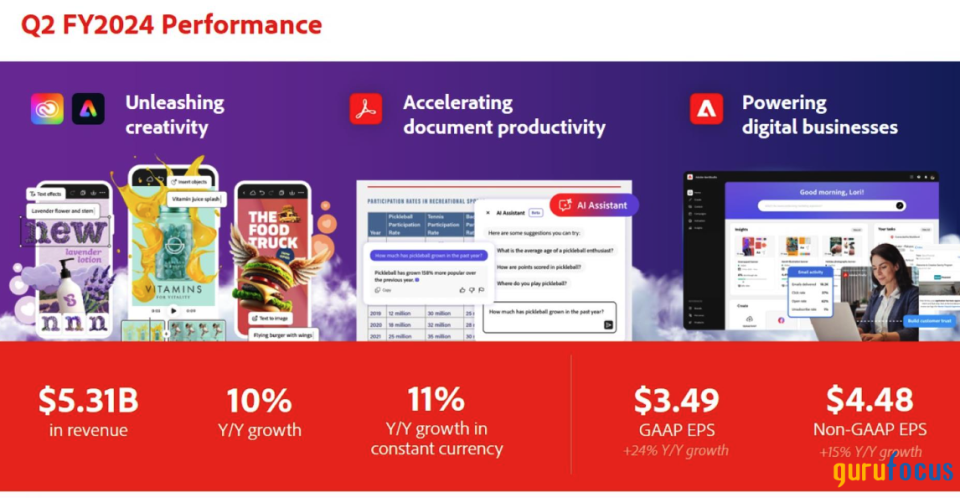

Strong revenue and margin growth

Adobe continues to run a highly profitable software business, benefiting from a sustained uptrend in its margins over the years. In the second quarter, the company reported revenue of $5.31 billion, a 10.10% year-over-year increase, and adjusted earnings of $4.48 per share, a 14.50% increase, both exceeding original midpoint guidance.

Much of Adobe’s top-line success can be attributed to its sticky SaaS offerings, evidenced by the growing Digital Media ARR of $16.3 billion (up 14.90%), Creative ARR of $13.10 billion (up 12.60%) and Document Cloud ARR of $3.20 billion (up 26%).

Adobe’s management has been prudent in their guidance, allowing the company to consistently beat top and bottom-line expectations over the past six quarters. The AI developments are expected to continue supporting revenue growth, particularly in creative services where it excels in pricing and product integration. Analysts project its revenue growth to stabilize around 11% annually, a reasonable expectation given the company’s strong positioning in advanced AI creative services.

Adobe: Leading the Charge in AI-Powered Creative Software

Source: Adobe

Exceptional margin performance

Adobe’s profitability is also reflected in its expanding gross profit margins, which reached 88.70% in the second quarter, up 0.60 points year over year and 3.80 points from 2019 levels. The company’s adjusted operating margins also improved to 45.90%, up 0.60 points year over year and 6 points from 2019. The company’s high net margin is notable compared to its peers and its growth rates are competitive, outperforming companies like Microsoft (NASDAQ:MSFT) in terms of top and bottom lines and free cash flow growth over the past five years.

While many companies stand to benefit from margin expansion due to automation and AI, Adobe, along with Microsoft and Salesforce (NYSE:CRM), is likely to see more accretive results from proprietary AI integration. The company’s high-margin software business, built on high-performance productivity tools, is generating strong free cash flows. Tools like Adobe Firefly promise significant productivity gains for creators, which should accelerate adoption. Despite a $1 billion acquisition termination fee payout to Figma affecting cash flow generation, the company still produced $1.90 billion in free cash flow last quarter, returning $2.50 billion to shareholders.

Strategic share repurchases and future projections

Adobe has been actively repurchasing shares, entering into accelerated share repurchase agreements and buying back 7.70 million shares in the second quarter alone. I expect the company to continue this trend and potentially exhaust its stock buyback authorization well before it expires in March 2028.

The company’s free cash flow margin remained robust despite a slight moderation to 35.13% in 2023 due to a lower operating cash flow margin. However, Adobe’s capital expenditure as a percentage of revenue remains low at 1.90%, consistent with its historical average, due to its strategy of partnering with cloud companies rather than relying on its own data centers. Looking ahead, I project Adobe’s three-year forward net margins and free cash flow margin to be 25.21% and 34% respectively, considering the increased expenses associated with AI developments. Adobe’s capital-efficient business model bodes well for its future free cash flow margins, reinforcing its strong financial position and growth potential.

Adobe: Leading the Charge in AI-Powered Creative Software

Source: Adobe

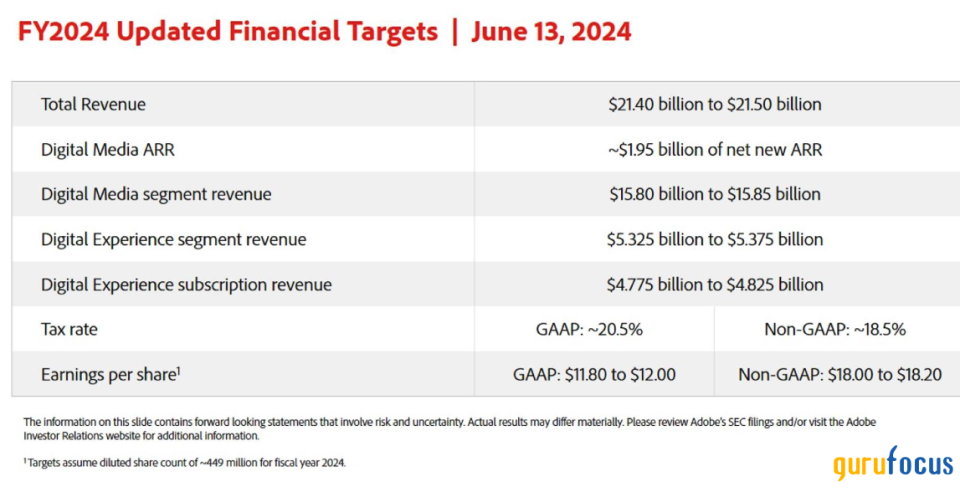

Upside potential

Adobe recently raised its 2024 revenue guidance to $21.45 billion, reflecting a 10.50% year-over-year increase, and adjusted earnings per share guidance to $18.10, a 12.60% rise. This revision from the previous guidance of $21.4 billion and $17.80 has led to a consensus of raised forward estimates.

The market now expects Adobe to achieve a bottom-line expansion at a compound annual growth rate of around 14.10%. Consequently, Adobe’s forward price-earnings valuation has seen a moderate upgrade to 25, indicating improved market confidence in its long-term prospects.

Despite this optimism, the stock remains inherently discounted compared to its historical multiples of 33.50 times (five-year median forward price-earnings) and 32 times (10-year median forward price-earnings ratio). In comparison to other enterprise SaaS peers, such as Microsoft with a forward earnings multiple of 38 and an adjusted earnings per share CAGR of 16.90%, Oracle (NYSE:ORCL) at 25 (with a CAGR of 14.40%), Autodesk (NASDAQ:ADSK) at 30.50 (with a CAGR of 11%) and SAP (NYSE:SAP) at 33.5x (with a CAGR of 13%), Adobe is still reasonably valued. Based on the consensus raised 2026 adjusted earnings estimates of $23.87, with a potential upgrade in its forward price-earnings ratio closer to its 10-year median of around 33, I believe there is an expanded upside potential of 35% to a long-term price target of $752.

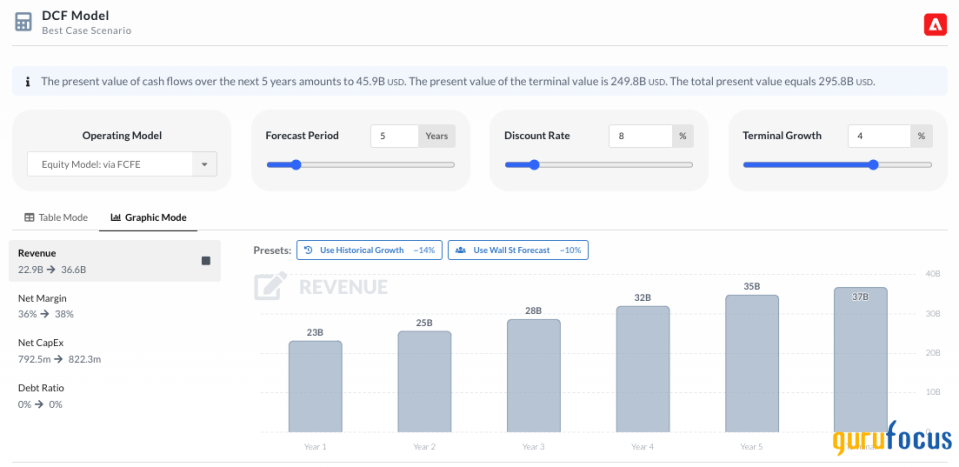

Adobe: Leading the Charge in AI-Powered Creative Software

Source: Alpha Spread

From a discounted cash flow valuation perspective, using a weighted five-year forward revenue growth average of 10%in line with Wall Street consensus and reflecting Adobe’s robust growth potential supported by its AI enhancementsa discount rate of 8% and a terminal growth rate of 4%, we derive an intrinsic valuation of $667. This indicates 17% upside, providing a sufficient margin of safety to recommend a buy at current levels. This upgrade is justified as Adobe remains undervalued, particularly given its strong share repurchase program worth $7.20 billion, with 7.30 million shares (1.50% of its float) retired over the last 12 months and 37.50 million shares (7.60%) retired since 2019, demonstrating robust shareholder returns.

Final thoughts

Adobe continues to dominate the creative software industry, leveraging its strong AI capabilities to enhance its product offerings and maintain a competitive edge. Despite market volatility, the company’s financial performance remains robust, with strong revenue and earnings per share growth. The company’s strategic investments in AI and disciplined financial management underscore its potential for sustained growth.

With a reasonable valuation and significant upside potential, Adobe presents a compelling investment opportunity for long-term growth.

This article first appeared on GuruFocus.