Alongside finance leaders from an array of industries, CFO attended Gartner’s CFO and Finance Executive Conference last week in National Harbor, Maryland. Unsurprisingly, some of the most coveted contemporary disruptors dominated conversations. In what hauntingly sounds like the cryptocurrency and blockchain technology discussions at its peak of hype in 2021, finance leadership’s fascination and planning around AI’s influence in their work was prevalent in both speaking and side conversations.

From start-ups labeling themselves with AI in their branding, to legacy companies building and showcasing AI-driven products, this conference was all in on the idea that AI is a game-changer that finance leaders should not take lightly.

But tech talk wasn’t the only topic of conversation. Many spoke about the adjustments in leadership necessary in today’s working environment. Facets such as showcasing authenticity and vulnerability to employees, the delegation of decision-making, and collaboration with other departments were highlighted as ways to grow alongside technology, not compete with it.

Below are seven conference takeaways that CFOs and fellow leaders should be aware of as AI’s influence in corporate finance and financial leadership becomes increasingly more present.

1. Leadership Must Be Adaptive

Resting on the laurels of leadership styles that have worked in the past will be detrimental if AI’s impact is as big as Gartner’s leadership claims it will be. CFOs and teams who don’t adapt their leadership styles will have a difficult time incorporating new technologies into their systems.

If employees are guided and instructed by technology to do their jobs, leaders who are output-focused with little regard for how or who gets the work done will be doomed. Employees, many of whom already have a troubled sense of belonging or purpose in the workplace, won’t be able to be productive with new technologies if their leaders don’t adapt to become more hands-on, collaborative, and authentic.

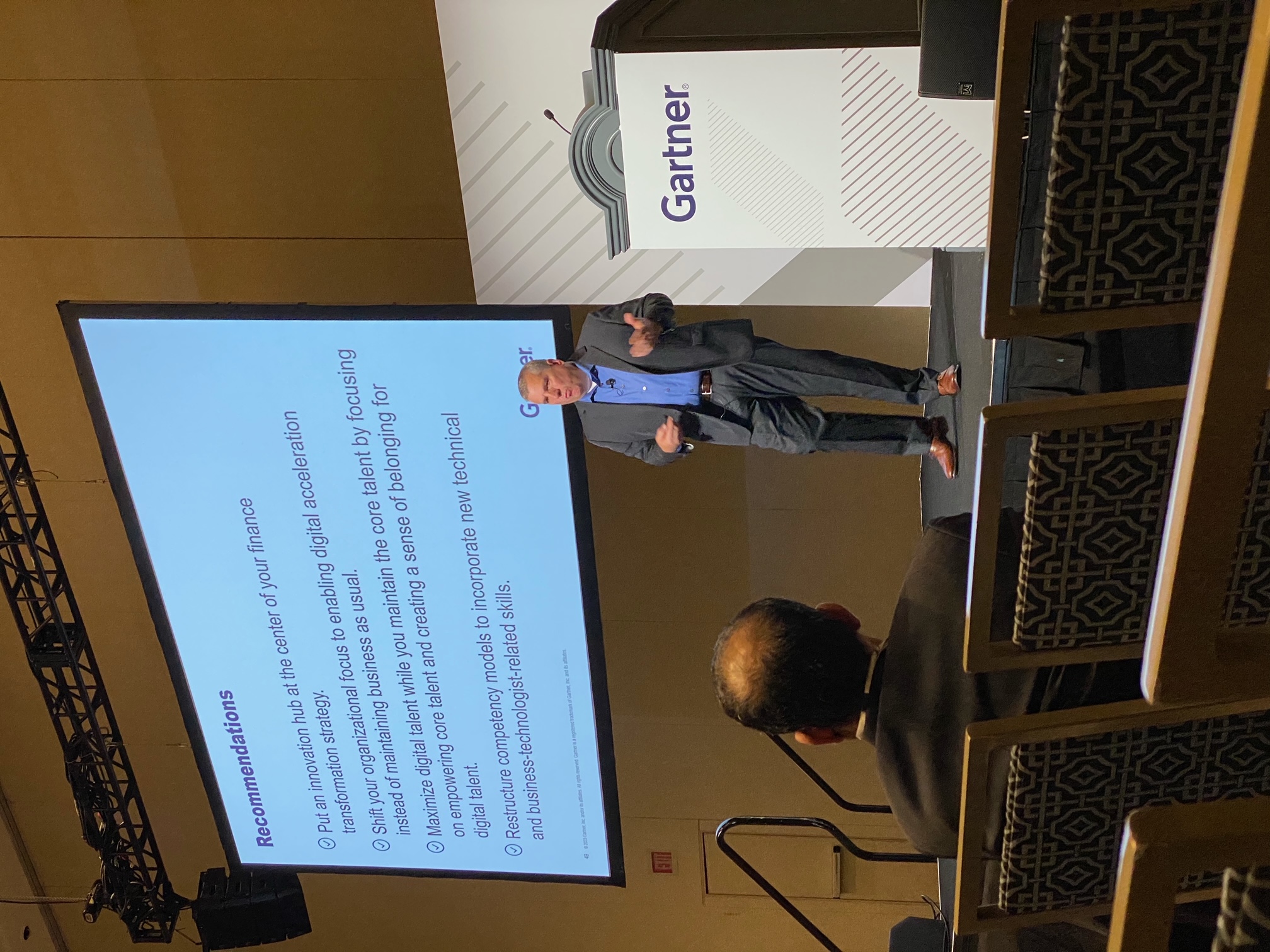

Mike Helsel, senior director analyst of finance research and advisory at Gartner, gives a talk on using finance as an innovation hub.

2. Employees Must Go From Doers to Operators

With productivity paranoia’s prevalence in remote work environments, the incorporation of AI into workspaces may cause employees to look over their shoulders. Finance leaders should be training and hiring employees not to just do work, but to run the machines that will do the work for them.

To accelerate autonomous finance in accounting departments and beyond, CFOs and their fellow executives must put time and resources into training or hiring employees who are just as well-rounded with the technology as they are with the tasks that the technology is designed to complete.

3. Core Talent vs Digital Talent

When incorporating new technologies, leadership must first identify which employees will embrace these technologies, and which will not. Bisecting staff into two categories — digital talent and core talent — will aid in adaptation. Core talent is comprised of those who function best in manager and/or specialized roles that may not be easily automated. Digital talent are those whose work and skill sets are easily or already integrated with technology. The latter group likely needs less guidance in disruptive tech than their core counterparts.

This assessment provides an opportunity for leaders to see which areas of their company’s staff are best prepared for new technologies. CFOs can identify which areas need specific training, and which areas of the company needs more digitally literate employees.

4. Make ‘Finance IT’ its Own Entity

Much like how cybersecurity is no longer viewed as insurance, IT can no longer be viewed as purely virtual maintenance to the finance department. As technology drives innovation and operations around finance, companies wishing to incorporate these new technologies may be best suited to develop finance-specific IT departments. This will not only put companies in a strong position to remedy any potential tech problems that may occur, but will provide an experienced and ‘non-finance’ perspective on future incorporation, should leadership choose to collaborate with their finance IT teams in decision-making.

5. Develop Strong Financial Discipline

There is a fine line finance leaders must walk among their teams and fellow leaders when it comes to being able to be personable but also firm in conviction. Strong leadership must always be able to say “no” to the wrong ideas, even to the company’s CEO, and provide data or metric-based reasons why.

Falling into groupthink, or the buzz around innovation or incorporation of exciting new technologies can be lethal to a company that is trying to innovate on a budget. Finance leaders must pair their approachability with skepticism, and cannot be afraid to kill an idea that sounds expensive, premature, or just plain silly.

A sales rep from Sidetrade struts his company colors in the showcase hall.

6. Create an AI-Ethical Framework

Leaders must decide what the ethics around AI mean to the company. These ethics and the corporate governance around it are some of the tech’s biggest concerns, and companies who wish to adopt it in their workflows must be aware.

Whether it’s through legal, consulting, executives, or a company-wide meeting, those who wish to get the most out of AI must first set a framework regarding a sense of ethical practices it is operated within.

7. Value-Driven Innovation

Directionless tech acquisition resulting from falling victim to a good sales pitch, a flashy trend, or influence from peers, is a potential waste of resources.

CFOs and controllers alike desire value-driven functions out of their new technologies. As pressures rise, leaders must identify not only what areas are ripe for innovation, but which have stickier value propositions after the innovation is complete. According to various conference experts, “hyper-automation” shouldn’t be a priority.

It’s not a race to the finish line when it comes to technology, but rather a test of adaptability and seeing which companies have the best systems for vetting, evaluating, and incorporating the right technology for them at that moment.

![]()