Founded in 2016 and based in Dublin, Webio has had a good year with a growing list of clients and further expanding into Europe – and as far as Africa.

When artificial intelligence tools such as Alexa and Google Assistant were made accessible to the everyday user about a decade ago, many thought that this was the beginning of a revolution in the way humans interacted with the world around them. But they proved to be of little use other than setting alarms, scheduling calendar reminders and perfunctory web browsing.

It was only after the advent of large language models (LLM) such as OpenAI’s ChatGPT that one could imagine a truly meaningful AI revolution to take place – answering much more challenging questions in a conversational style while also remembering past conversations.

Paul Sweeney, who has more than two decades of experience designing and delivering product strategy for internet and software companies, thinks that while many features of LLMs such as disambiguation (understanding what a user is trying to say) make them great for consumer use, they have “inherent flaws” when it comes to deployment at the enterprise level.

“To be useful in enterprise settings, they absolutely must not hallucinate, they must be safe to use, compliant and fully auditable. Even more so in the world of financial services and in the world of collections, which have additional rules and codes of behaviour that must be adhered to,” explains Sweeney, co-founder and chief strategy officer of conversational AI start-up Webio.

Training models on real customer data

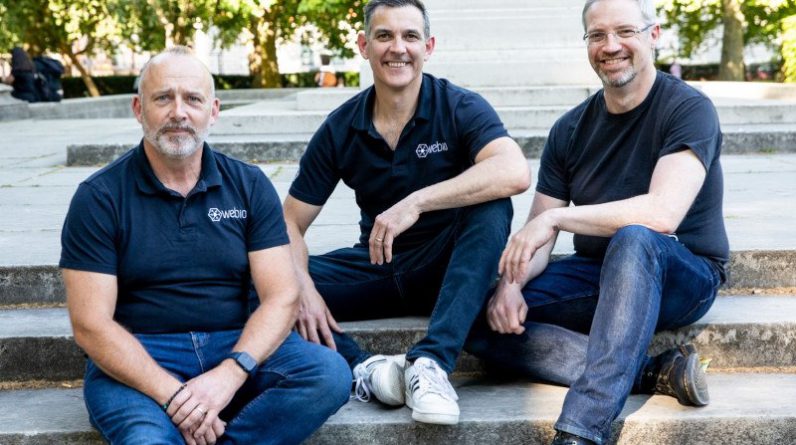

To address this challenge, the founding team of Dublin-based Webio, which includes CEO Cormac O’Neill and chief revenue and marketing officer Mark Oppermann, decided to develop an architecture that leveraged multiple open-source language models, each focused on a specific task, and to make them work together in an orchestrated workflow.

Aimed at companies in financial services, utilities and large-scale retail sectors, the conversational AI platform allows customers to connect through SMS, WhatsApp, Webchat or an online portal to perform a range of tasks, from delaying payments and changing payment dates to setting up new repayment arrangements.

“With explicit customer permission, each model is fine-tuned and trained on real customer data using our proprietary AI tools. This ensures that the language and concepts of your organisation are reflected in the models,” Sweeney explains.

Combined with Webio’s natural language understating engine and industry-specific API, these custom language models enable enterprises to integrate their own data into their customer conversations, ensuring visibility throughout the system and allowing the team to “explain why decisions, suggestions and content were presented”.

“To compete in AI-powered services within financial services, explainable AI and a privacy-first design are essential. By committing to these principles, Webio enables customers to adopt AI-powered features within the Webio platform. These features help customers get answer to their questions, to change how they might want to pay or engage with a human agent that can help guide them to a solution that works.”

How things are going

Founded in 2016 and headquartered in Dublin’s Temple Bar, Webio has made a reputation for itself as one of the most promising conversational AI start-ups in Europe. Two years ago, it secured $4m in a Series A funding round led by Amsterdam-based Finch Capital. And then last July it raised another €2.5m led by Hambro Perks to grow its AI platform across Europe.

Some of the companies that use or have used the Webio platform across Ireland and the UK include The Very Group, Studio Retail, Hoist Finance, DCBL, NCO Europe and Anglian Water.

This has been a good year for Webio. Sweeney said that the start-up has attracted “some very large companies” to its platform and expanded into multiple European countries as well as Africa.

“Our focus now is on getting these companies up and running efficiently on the Webio platform. A high-quality problem to have for sure,” he said.

“What matters is overcoming these obstacles as a team. Maintaining a strong vision and fostering a resilient culture is crucial to getting through. Leadership must exemplify the behaviours and mindsets that guide employees can emulate in order to get through the inevitable tough times. So we might say that the real challenge to overcome is growing that culture and being true to the principles you set out.”

Find out how emerging tech trends are transforming tomorrow with our new podcast, Future Human: The Series. Listen now on Spotify, on Apple or wherever you get your podcasts.