AsianFinâ As DeepSeek ignites global enthusiasm for next-generation AI models, China is solidifying its leadership in AI foundational research and industrial development.

Latest figures from CCTV show that as of April 9, 2025, China had filed 1.5764 million AI-related patent applicationsâaccounting for 38.58% of the global totalâsecuring the top global ranking. Simultaneously, China has fostered over 400 national-level “Little Giant” enterprises specializing in AI, representing roughly one-tenth of the global AI industry scale. A full-stack AI industrial system has taken shape, spanning foundational, framework, model, and application layers.

Meanwhile, the 2025 AI Index Report, released by Stanford HAI under the leadership of Fei-Fei Li, shows AI patent filings have surged from 3,833 in 2010 to 122,511 in 2023. In 2024 alone, filings jumped by nearly 30%. China holds 69.7% of the world’s authorized AI patents, though South Korea and Luxembourg outperform on a per capita basis.

At the International Conference on Learning Representations (ICLR) 2025 in Singapore, a joint team from Alibaba DAMO Academy (Lakeside Lab), National University of Singapore, and Tsinghua University unveiled a new open-source visual generation framework, DyDiT. The innovation intelligently allocates resources across time steps and spatial regions, cutting inference computational demand by 51% and boosting generation speed by 1.73x over the standard DiT model.

The conference featured key figures from Google DeepMind, Microsoft, Meta, UC Berkeley, the University of Science and Technology of China, and AI luminaries like Geoffrey Hinton and Yann LeCun. Research achievements presented rivaled the impact of ChatGPT, highlighting the continued dynamism of the large model race.

The ICLR 2025 saw 122 workshop proposalsâa 1.18x increase from last yearâwith 40 accepted, doubling 2024’s number. High-profile participants included Stanfordâs Danqi Chen, UC Berkeleyâs Dawn Song, and Tsinghua’s “Yao Class” alumni.

Driven by DeepSeek’s global rise, competition among large model developers remains intense. Public data shows 49 new large models launched in Q4 2024 and 55 more in Q1 2025, with some weeks witnessing eight releases.

Alibaba DAMO Academy remains a major player, with 13 papers accepted at ICLR 2025 across video generation, NLP, medical AI, and genetic intelligence. Notably, the DyDiT framework addresses inefficiencies in the popular DiT architecture used by models like Stable Diffusion 3 and Sora.

By enabling adaptive computational adjustments during visual generation, DyDiT dramatically reduces redundancy and waste. The training and inference code is open-sourced, with plans to integrate DyDiT into more text-to-image and text-to-video models, such as Dy-FLUX based on FLUX.

StepAI, another Chinese AI player, had four papers accepted at ICLR, focusing on video MLLMs, personalized image generation, and large model supervision.

The ICLR 2025 Outstanding Papers included collaborations between Google DeepMind, Princeton, UC Berkeley, and Meta, showcasing advances in model alignment, data efficiency, and fine-tuning dynamics.

Beyond China, AI powerhouses are in flux. OpenAI’s plan to transition into a Public Benefit Corporation (PBC) faces strong opposition. Geoffrey Hinton, Stuart Russell, Margaret Mitchell, and others have petitioned the U.S. Attorney General to halt the restructuring, arguing it threatens OpenAI’s nonprofit mission.

Elon Musk is simultaneously ramping up his AI ambitions. His xAI Holding, merged with X, is seeking over $20 billion in fresh funding at a post-investment valuation exceeding $120 billion. Funds could help refinance Xâs high-interest debts.

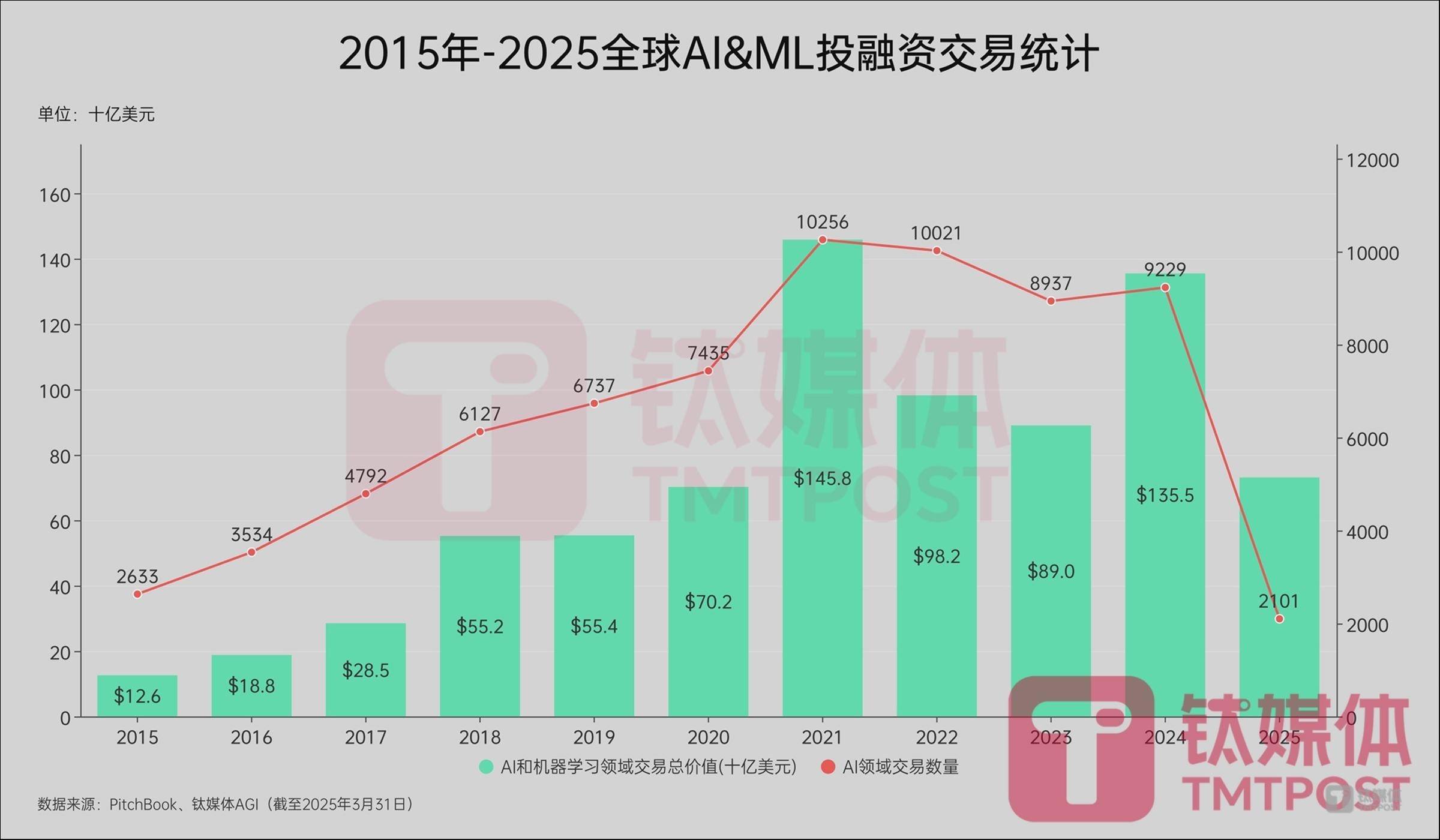

Meanwhile, OpenAI itself recently secured $40 billion in new funding led by SoftBank, reaching a stunning $300 billion valuation and accounting for over half of U.S. venture capital funding this year. OpenAI expects its AI agents and new products to overtake ChatGPT revenues by 2030, projecting $174 billion in sales.

Despite China’s dominance in patents and research output, commercialization still lags. Only 4% of global ToB software companies valued above $10 billion are Chinese, according to Gaosheng Investment.

VC veteran Zhu Xiaohu notes that while enthusiasm around foundational models is cooling, AI application startups are booming with weekly growth rates nearing 10%. He urges startups to embrace open-source models and focus on real-world applications rather than wasting resources on model training.

ByteDanceâs infrastructure team recently showcased how it uses large models to optimize system operations, saving over 1 billion RMB in three years. Meanwhile, AI unicorn Step AI launched its image editing model Step1X-Edit, claiming top open-source performance, and announced deep collaborations in automotive and smart device sectors.

As competition intensifies, experts warn that companies must integrate generative AI rapidlyâor risk being left behind. Zhu summarized the fierce environment best:

“The vast ocean eventually turns into a red ocean; the dirty and exhausting work ultimately becomes the moat.”è¿åæçï¼æ¥çæ´å¤